That's a lot of money!The New York Times has a

financial story that includes this graphic: (reduced 25% in size from the original)

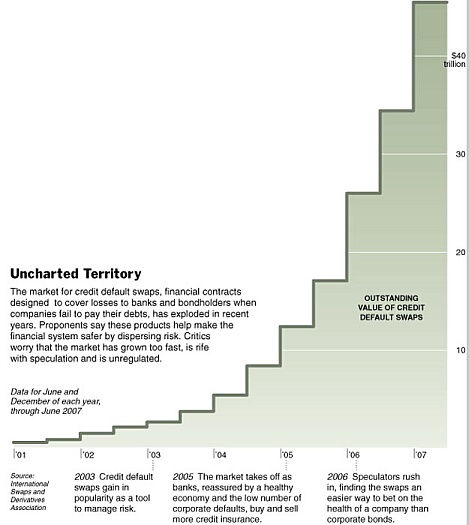

Even if you don't know much about Credit Default Swaps (I sure don't) look at the size and enormous growth in the "value" of the CDSs.

When fretting about losses these days, mere billions of dollars are punk. Even a trillion or two doesn't cut it. But gaze upon the bar chart that

exceeds $40 trillion dollars.

Yes, some of them may offset each other. Yes, some are never going to be called upon. But it's still a good indicator of how much debt (risky and not so risky) has been created in recent years. It's staggering.

posted by Quiddity at 3/23/2008 12:43:00 AM

the full Derivative exposure for iBanks, via Jesse's Café Américain - chart from Comptroller of the Currency ...

assets total $9.3 TRILLION

derivative exposure $172 TRILLION

Jesse's Café Américain

Clearly the solution is deregulation and more corporate tax cuts...